What are Syndicates?

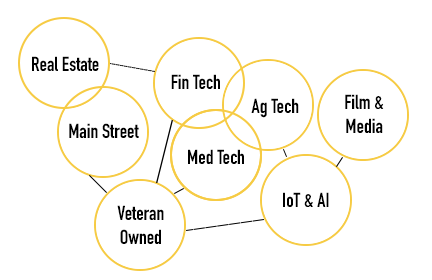

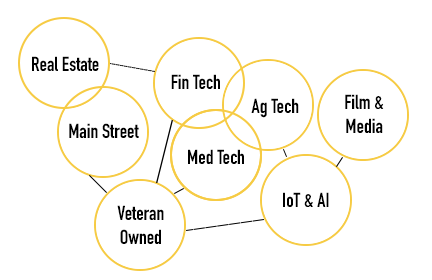

Syndicates are groups of like-minded investors and organizations that come together to build ventures in their community. They typically are composed of investors with common interests or focus on a specific industry. Ranging from IoT, Main Street Businesses, Med Tech, or Real Estate, chances are there’s a syndicate for your locality.

What are Syndicates?

Syndicates are groups of like-minded investors and organizations that come together to build ventures in their community. They typically are composed of investors with common interests or focus on a specific industry. Ranging from IoT, Main Street Businesses, Med Tech, or Real Estate, chances are there’s a syndicate for your locality.

What are Syndicates?

Syndicates are groups of like-minded investors and organizations that come together to build ventures in their community. They typically are composed of investors with common interests or focus on a specific industry. Ranging from IoT, Main Street Businesses, Med Tech, or Real Estate, chances are there’s a syndicate for your locality.

$4 Billion +

Companies have raised over $4B via online Syndication nationwide…and are growing over 50% YoY

$4 Billion +

Companies have raised over $4B via online Syndication nationwide…and are growing over 50% YoY

$4 Billion +

Companies have raised over $4B via online Syndication nationwide…and are growing over 50% YoY

No matter your interests, there’s a syndicate for you!

Syndicates allow investors to review deal terms, vet founders and ventures, and directly invest in high-growth startups.

Many syndicates overlap industries, and you can join as many as you want without requiring an investment.

via NCGrind.com

Do I need to have experience to join a syndicate?

What type of deals show up in a Syndicate?

What is a CrowdfundNC Syndicate?

Can only accredited investors participate?

How do I join a syndicate?

Can I form my own syndicate?

What is the minimum I can invest?

What is Carried Interest (aka Carry)?

How many deals should I expect to see each month?

What is the set-up (Admin) fee?

Is there a portal I can log into to see previous deals?

Who are syndicate leads?

What is Localstake?

Localstake is a registered Broker Dealer. As a Broker Dealer, they allow businesses to sell any type of exemption available which means founders have the flexibility to choose exemptions (including accredited and non-accredited) that best meet their business’s strategy.

How does this help investors?

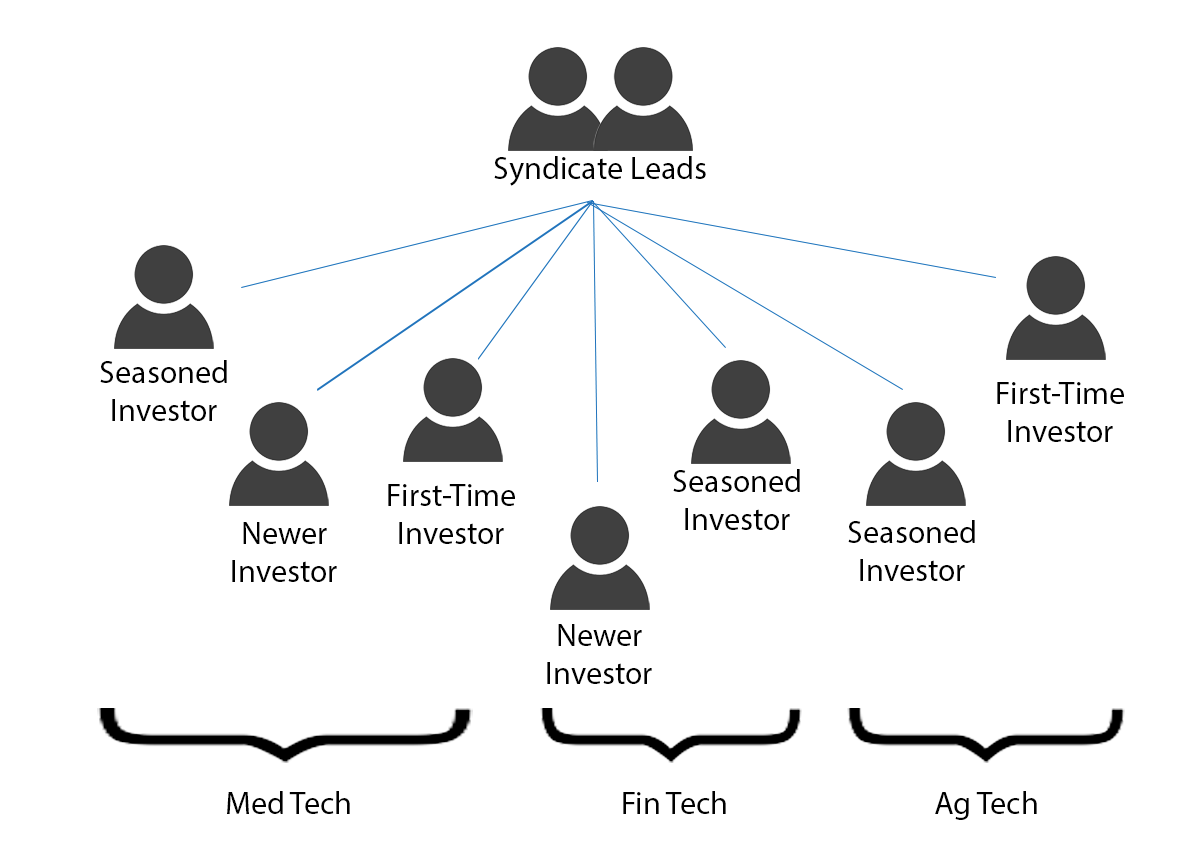

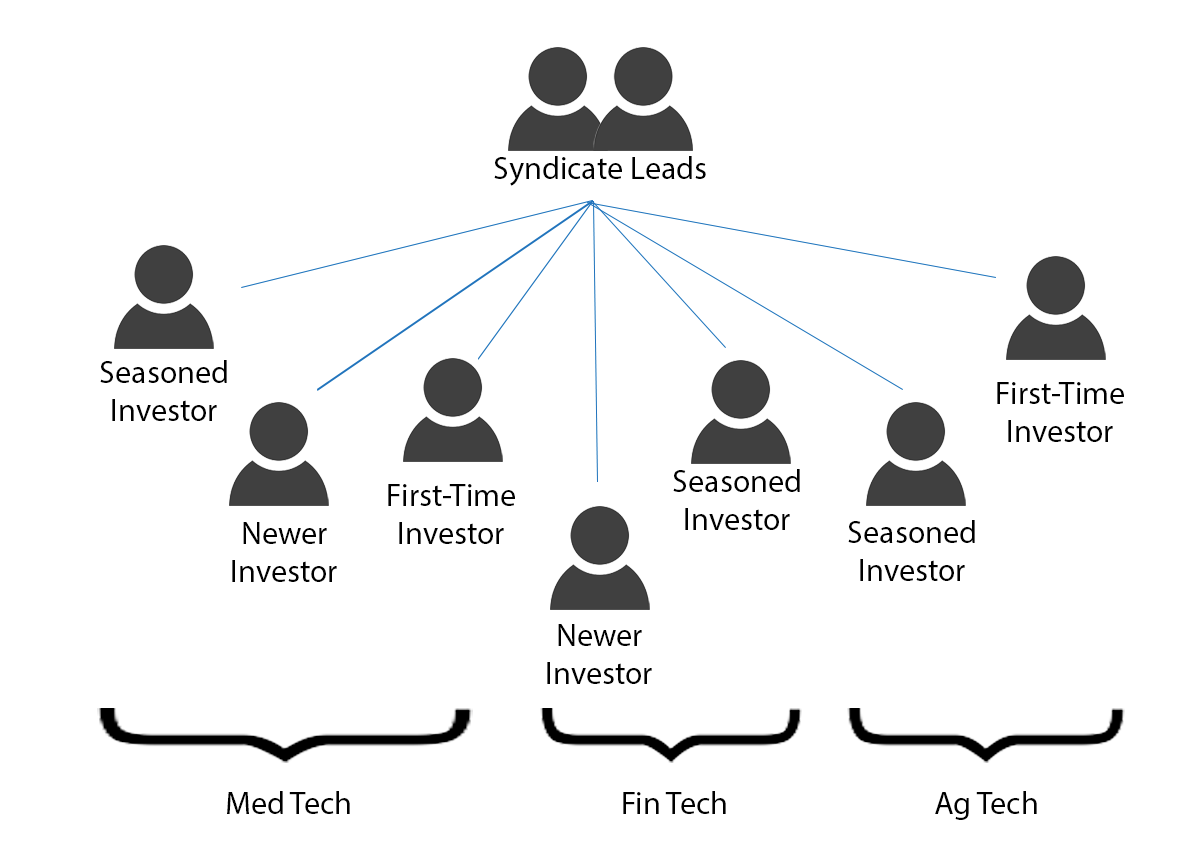

- Provide newer investors access to invest alongside experienced investors

- Allow investors to have a better deal flow

- Have lower minimum investments which allows investors to diversity their portfolio

How does this help founders?

- Get the supervision of a Lead who is bringing along a good size potential investment from the syndicate.

- Get access to the syndicate investors’ networks and expertise.

- Can easily manage the financials and cap table through a Special Purpose Vehicle (SPV) fund that invests in their startup, rather than adding many small investors to their cap table.

This tool is for illustrative purposes only, to outline the mechanics of how syndicate investing works. The scenario is not representative of any particular investment. There is no guarantee that an investment will be profitable and you may lose your entire investment. Please review the applicable Offering Materials for a full discussion of the risks, costs, expenses, liquidity, safety, guarantees, and tax features of the syndicate before investing.